SavingsInsights

Be informed and stay up-to-date with the latest High-Yield Savings Account (HYSA) interest rates! View historical data to check trends, avoid promotional gimmicks, and compare banks!Whether you're just learning about HYSAs and how they keep your cash from rotting away in a traditional savings account, or an HYSA expert looking to move your money to the best earning accounts, this site is for you!

Current List of Banks Tracked

Welcome to SavingsInsights

If you're anything like me, financial decisions matter. Whether you're planning for short-term expenses, securing your medium-term goals, or strategizing for a comfortable retirement, making informed choices is crucial. That's where SavingsInsights comes in – your trusted companion in navigating the world of interest rates and optimizing your financial future.

Exploring Your Options

Traditional Savings Accounts: These familiar accounts manage everyday finances but offer minimal interest gains. The Balance talks about how traditional savings account yields remained relatively low (with some nice charts too). For instance, $10,000 in a savings account for 3 years with a 0.25% APY, would only earn $226.69 in interest.

High-Yield Savings Accounts (HYSAs): These account types are a game-changer. They are very similar to traditional accounts, but with interest rates often at least 4-5% APY, they outperform traditional accounts by a substantial margin while still giving you full access to your money when you need it without penalties. With a 5% APY, after 3 years, you'd earn $1,576.25 in interest!

Long-Term Planning: Retirement and Brokerage Accounts: For long-term planning or funds you don't need immediately, retirement and brokerage accounts offer growth potential. However, these investments carry market risks. Keep in mind that sudden withdrawals might force you to sell stocks at an inopportune time, potentially incurring penalties or tax implications.

Why High-Yield Savings Accounts (HYSAs)?

Most HYSA accounts are online only accounts (so no brick-and-mortar buildings and in-person tellers usually), but most have both web and mobile app access. You can transfer, deposit, and withdrawal your money to other accounts pretty easily. And like traditional savings accounts, your money is secure, with FDIC or NCUA insurance covering balances up to $250,000. So for my short and medium term financial needs, I found HYSAs to be a great option to save and hold my money!It's also a great way to fight inflation! Earning 4-5% APY in an HYSA compared to the 0.25% APY in traditional accounts helps prevent losing the value of your money over time.Some people prefer to put everything but their short-term (1-3 month) needs into brokerage accounts (the stock market), but I find that too vulnerable to market fluctuations for money I may need soon. Who wants to be forced to sell stock at a loss if you end up needing some cash. So I try to keep my 3-6 month emergency cash in HYSAs or CDs. CDs are less flexible than HYSA accounts though, and may incur penalties if you withdraw early.

Why Did I Start This Site?

When I first started looking at my savings options, I personally found it difficult to find the information I wanted to know about HYSAs. It took me many hours of research, bouncing between different bank sites, finding their current rates, writing them down in a notebook/spreadsheet, trying to compare them ad-hoc, then check back to make sure I found the best average rate; all while juggling a full-time software development job, family time, and life in general. Who has the time for that?!As Experian and CNBC noted, HYSA rates are variable can change at any time. I made this site to help you avoid all the pain of that research and monitoring rates, save time, and hopefully save lots of money too!My hope is that if this data can help you earn even an extra 0.5% APY, the extra interest earned would far outweigh the cost of this site!

High-Yield Savings Account (HYSA)

Interest Rate Tracker

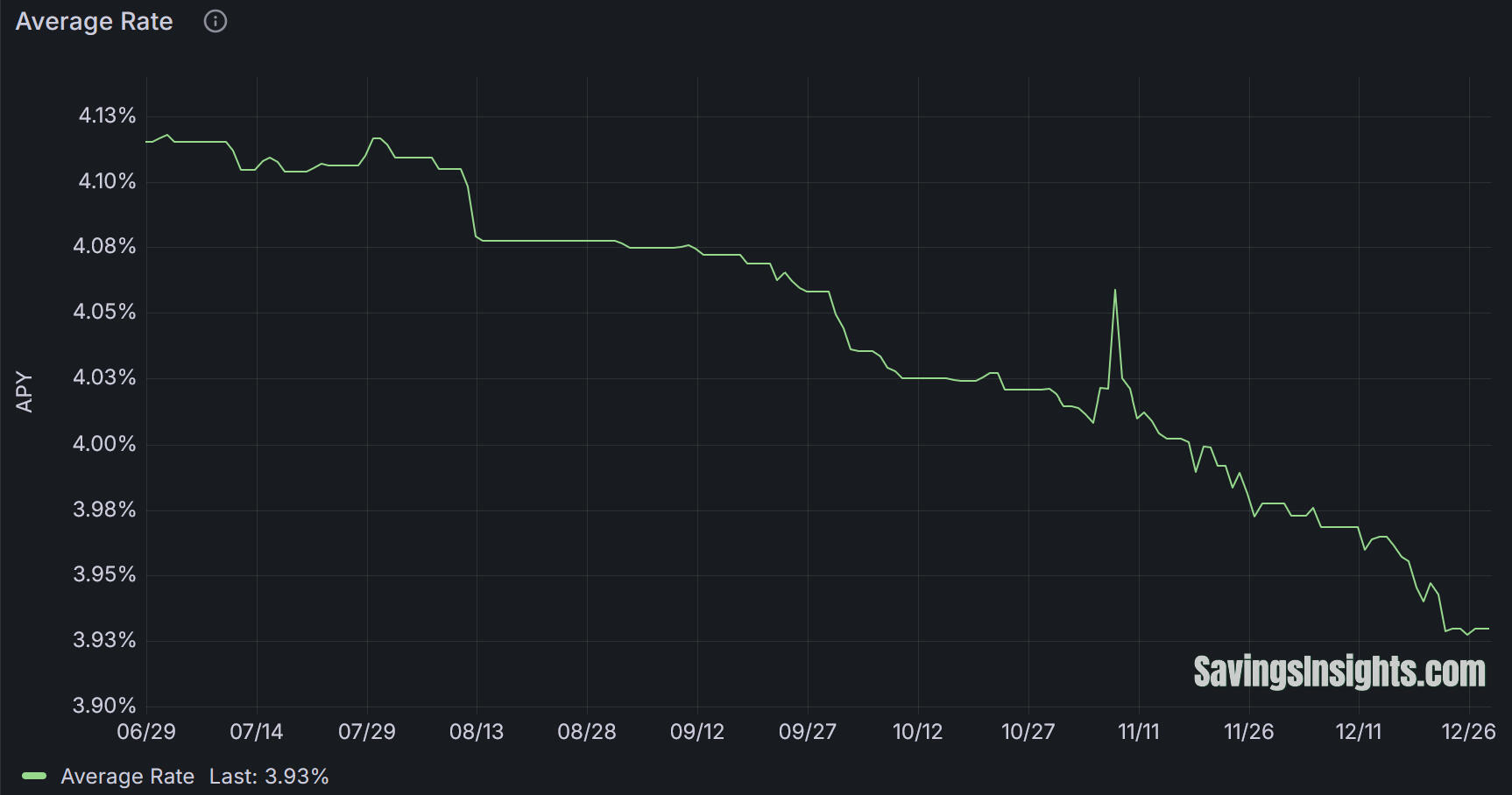

Our service tracks the current and historical HYSA interest rates of a variety of reputable banks and financial institutions.

Our rate tracker provides analytics and reporting so you can research your best options quickly!

20+ Banks Tracked

View interest rates (APY) from the top banks with the best rates.If you have a bank not listed, let us know! We'll work to add it!

24+ Months History

We've been collecting data for over 2 years now!Understand trends and avoid gimmick promotional rates.

Refreshed Daily

Our site automatically collects the published HYSA interest rates of reputable banks from across the Internet!Save time and effort researching where to save your hard-earned money!

How about a screenshot of our available report?

No, your eye sight isn't going bad. To view the full and current data, please help support our site by purchasing a report below.

Available Reports/Plans

We have a few options you can choose from to access the HYSA data the way you need it.

If you have any questions first, please contact us below!We're steadily working to improve our features and offerings, so check back often or contact us to stay informed!

If you're still on the fence, remember, if our report helps you even earn an extra 0.5% APY,

a $10,000 balance could grow an extra $150 in 3 years. A $25,000 balance could grow an extra $375+ dollars!I also operate this site totally independently and don't use the traditional ads or referral link model so I can focus on showing the best rates rather than what could earn the highest commissions or fees.

Single Report

$14.98

(Launch sale - 50% off, regularly $30!)

Purchase a one-time report of the best rates available with their last 60 days of history.

View current and average APY rates so you know a bank isn't just running a promotional rate!

Includes a chart to compare rates between banks.

Get the report emailed to your inbox.

Discount offered to get updated reports after the 1st!

(Note: The purchase will appear from Dynaridge Technologies/PayPal)

Monthly Subscription

COMING SOON

Get access to an interactive report of the best rates available with over 2 years of history.

View current and average APY rates so you know a bank isn't just running a promotional rate!

Access the report 24/7 whenever you feel the need to check!

I aim for great customer satisfaction and hope that the report helps you make the best decision about an HYSA for your money. After your purchase, an email with the report will typically be sent the same day. (I'm working to automate this to make it instant, but please be patient with me).If you have any questions before/after your purchase, please let me know. I love customer feedback!

What's New and Upcoming!

What's new and available now:

Our HYSA Interest Rate Tracker has been collecting rates since June 2023!

Currently tracking 20+ banks.

The single report is now available for purchase!

What we want to build next:

EVEN MORE BANKS!

We're working to add a subscription plan to allow direct interactive access to the latest reports and data!

Provide customized interest rate alerts so you get notified if a bank starts to offer a better rate!

Read reviews of banks to rate their features and customer support

Submit your own review of your bank(s) for others to read!

Want to provide feedback on what we should build next?

Complete this survey, contact us directly, or email at info @ savingsinsights . com so we can build the best service possible!

Contact Us

Our Commitment

Our service is designed to assist you in making well-informed financial decisions. We're dedicated to providing you with real-time data on interest rates, helping you explore different options, viewing historical and current rates together, and ultimately save money. Over time, we'll continue to refine our offerings based on your needs and feedback.At SavingsInsights, we're not just about numbers; we're about helping give you the insights to better secure your financial peace of mind. Explore the world of HYSA interest rates with us and ensure your money works harder for you.

Disclaimer: Important Information About SavingsInsights

SavingsInsights is designed to provide general information about interest rates, savings accounts, and investment options. The content on this website is intended for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or professional financial planning.We are not financial advisors, brokers, or certified professionals. The information presented on SavingsInsights should not be considered as a substitute for seeking advice from a qualified financial advisor, investment professional, or tax expert. Decisions based on the information provided on this website are solely at your own risk.The accuracy, completeness, and reliability of the content on SavingsInsights are not guaranteed. Financial markets, regulations, and rates can change rapidly, and the information presented here may become outdated or inaccurate over time.It is important to conduct your own research, consult with qualified professionals, and consider your personal financial situation, goals, risk tolerance, and investment horizon before making any financial decisions. Always verify the accuracy of information and seek professional advice when necessary.SavingsInsights disclaims any liability for actions taken based on the information presented on this website. By using our services and accessing our content, you acknowledge and agree to these disclaimers and terms of use. If you have specific financial questions or concerns, it is recommended to consult with a certified financial advisor or relevant professionals before making any financial decisions.

© 2025 Dynaridge Technologies d.b.a. SavingsInsights. All rights reserved.

Thank you!

We'll keep you updated on our latest features and developments!